Be Clever when it comes to Banking

Restricted Refunding Options

Refunds can only be made to the user's original source of payment (credit card, bank account).

You can then release that money back to your customer instead of keeping it in their wallet to motivate them to use it on your e-commerce platform.

Higher Transaction Fees

A transaction fee is typically applied to these transactions, either a fixed amount or a percentage. This can add up quickly depending on ticket size and volume. Wallet-based systems.

No Additional Services

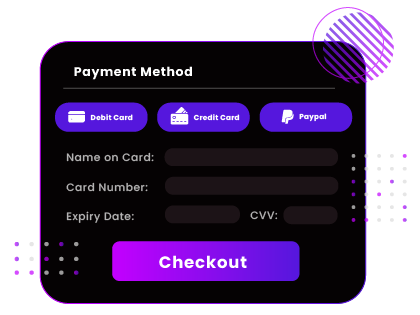

It is fairly straightforward to make payments using a payment gateway. Everything is simple from "checkout" to "payoff". E-wallet-based systems can handle such features directly, without the need for additional external systems to be implemented.

A process that handles end-to-end payments

Facilitating your financial success by guiding you through the process

This website provides the most extensive payment methods with domestic and international credit cards, EMIs, PayLater, NetBanking from 58 banks, UPI, and mobile wallets.

Checkout can easily work with cards that have been saved across different businesses, so that your customers can easily pay in all locations seamlessly with just a few clicks of the screen.

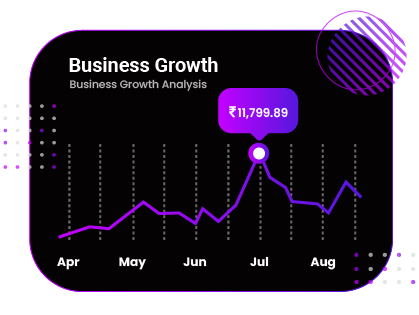

You can get detailed information on payments, settlements, refunds, and much more from our reports and statistics portal that will help you make better business decisions.

Banking beyond the ordinary.

The most basic definition of e-wallet, often also called a digital wallet or cyberwallet, is that of a virtual equivalent of a physical wallet. As such, an e-wallet acts as a subledger, a container for electronic money and virtual accounts within a virtual account management system. It can also store the user’s payment instrument details in a secure manner.

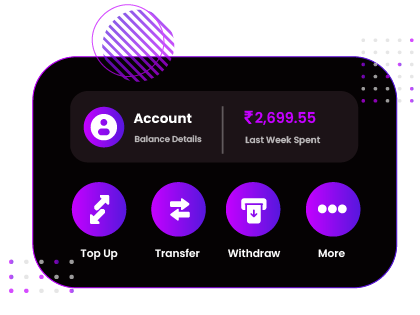

Count on us as your wallet leader

You will be amazed with what we do

E-wallets go easy on additional expenses. First off, you as the platform owner don’t have to pay fees for internal e-money transactions.

If the accounting module is built up accordingly, e-wallets can easily handle microtransactions, like fractions of the smallest monetary unit

The money can go directly back to the e-wallet instead of the original source of payment. For merchants and platform providers, this helps to keep users on the platform